Industry Topics Product News

Driving Down Viscosity

May 11, 2016 - By Infineum International Limited

While lubricant viscosity grade trends are hard to predict, the fuel economy improvements that can be gained from using thinner engine oils means we can expect the shift to lower viscosity to continue. Insight looks at the picture in Asia and the US and examines the impacts these trends might have on base stock demand.

The main driving force for using lower viscosity oils is the reduction of hydrodynamic friction, which improves fuel economy. As legislation to improve fuel economy and reduce CO2 emissions is introduced or tightened across the globe the desire to reap the fuel economy benefits that these lower viscosity engine oils can deliver means engine oils have been getting thinner and thinner.

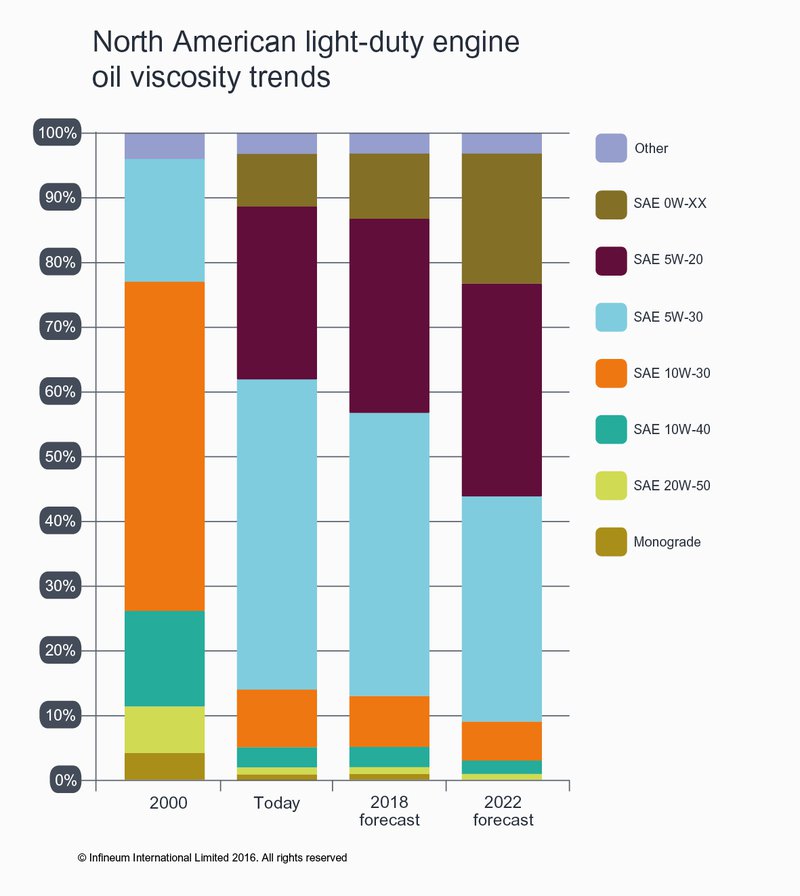

North American light-duty trends

In North America, over the past 15 years, we have seen the light-duty market move from around 50% SAE 10W-30 to almost 50% SAE 5W-30 today.

That might seem like quite a slow change, but vehicle population age and OEM market share both impact viscosity grade trends, which is why it can take a considerable amount of time for new viscosity grades to make up a significant portion of the overall market.

While SAE 5W-30 is now the most popular grade in North America it took from the late 1980s until 2006 for it to rise to this top market share position.

In our view, it will take a long time for it to exit the market - despite the fact that SAE 5W-20 and 0W-20 are now the most widely recommended grades for new cars.

In the future, although the trends are tough to call, we expect the thinner 0W grades to account for about 20% of the market by 2022, with the once popular SAE 10W-30 and heavier grades pushed right out to somewhere around 12% - quite a shift.

The introduction of SAE 0W-16 in North America with ILSAC GF-6, expected sometime in 2018, means this grade is likely to displace some SAE 0W-20 in this region as opposed to SAE 5W-XX or higher grades.

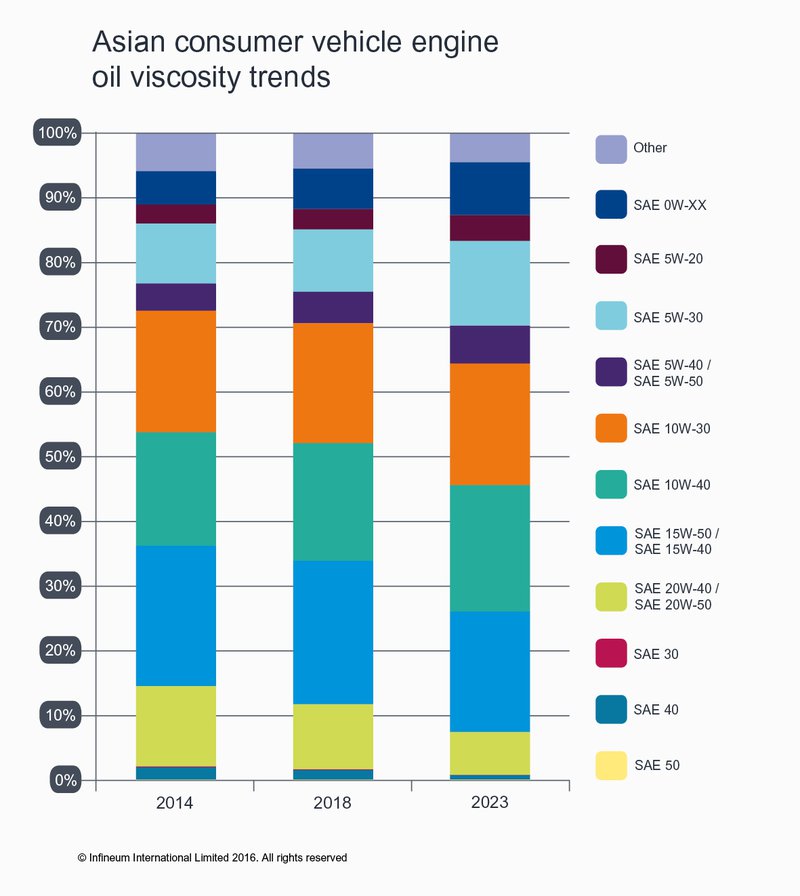

Asia – a more fragmented market

In the Asian consumer vehicle market the picture is quite different and much more fragmented. Whereas in North America today SAE 5W-30 and lighter account for over 80% of the market, in Asia, these grades only account for about 20%. And, although some growth in these very light grades is expected, it is anticipated that they will still only hold some 25% share of the market by 2023.

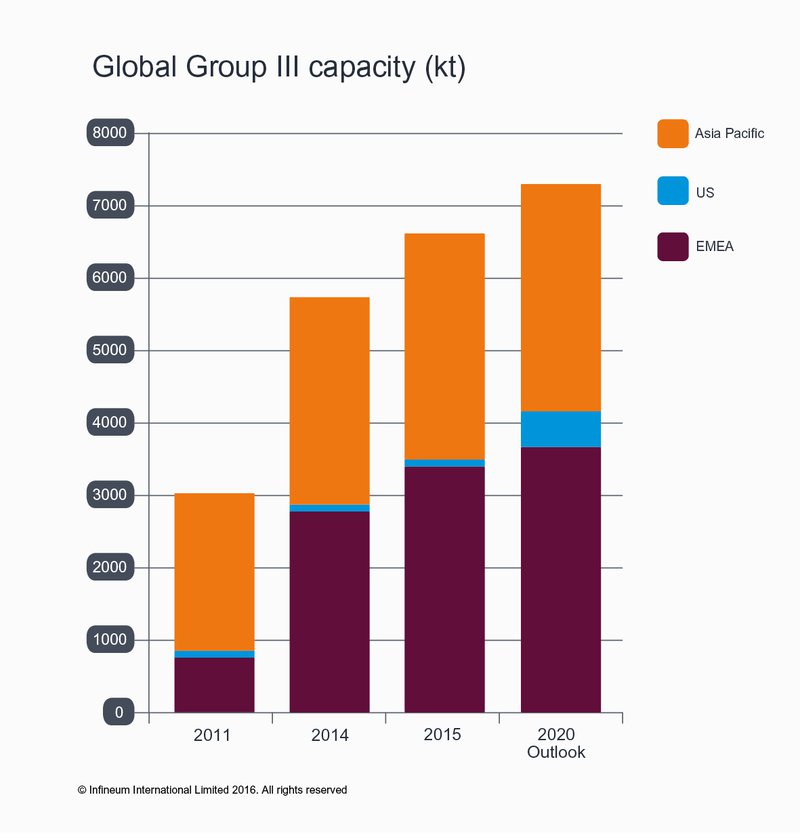

Just as we have seen in North America, the shift to lower viscosity in Asia is being driven by the desire for fuel economy and is being enabled by the increased availability of higher quality Group II, III and even Group III+ base stocks. However, while the shift to lower viscosities is happening quite quickly for factory fill oils, end users are only slowly adopting these grades as service fill oils, which continues to limit their penetration. When we talk to base stock suppliers in Asia they say they predict a slow growth for viscosity grades using Group III, but much larger growth for grades and quality levels that can use Group II.

While many OEMs suggest SAE 0W- 20 and 5W-20 will continue to meet their needs, some Japanese OEMs are already driving the introduction of ultra-low SAE viscosity grades to capture further fuel economy benefits. SAE 0W-16 oils are emerging, and some OEMs are looking to go even lower. SAE has now approved the definition of SAE 0W-8 and 0W-12, defining new limits for future engine oils built for even better fuel economy, which means the move to low viscosity grades may accelerate.

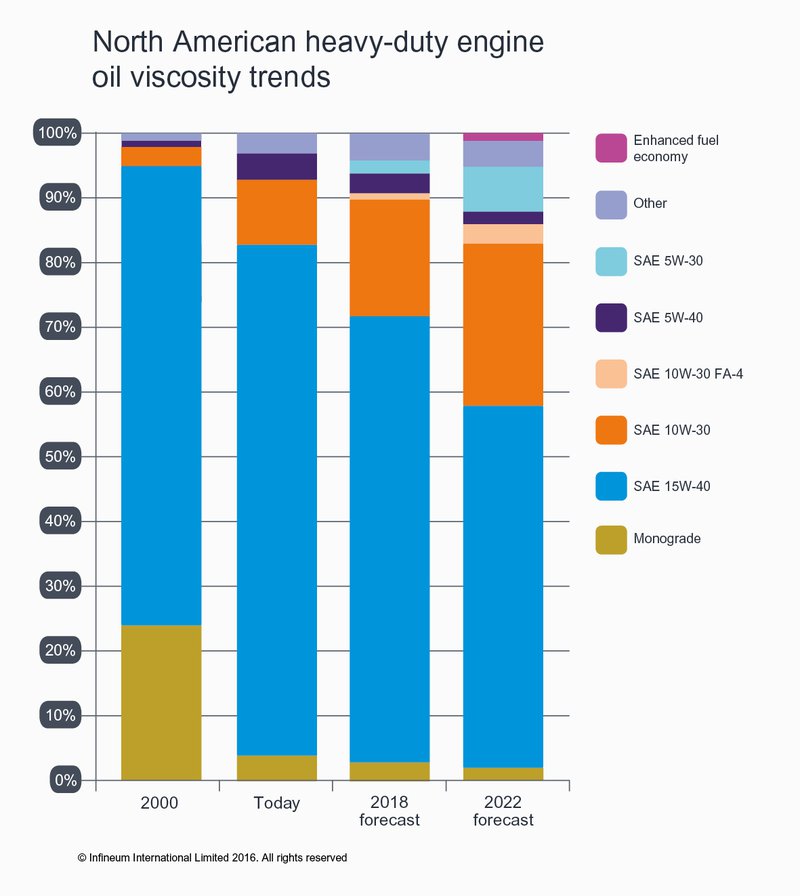

North American heavy-duty rolls to lower viscosity

The trend to lighter viscosity can also be seen in the North American heavy-duty diesel (HDD) market. The desire for fuel economy here is driven both by end user demand for lower operating costs and by greenhouse gas legislation. To meet these requirements OEMs have introduced new hardware and begun to look at lower viscosity lubricants.

This means monogrades have almost completely disappeared from the market. And, although SAE 15W-40 will remain the mainstay grade for the foreseeable future, sales of SAE 10W-30 have doubled in the past five years.

Now that PC-11 has been approved, with a first license date of December 1 2016, we can expect this trend to continue and possibly accelerate in the near term. Looking further ahead, although it is likely that we will see more uptake of low viscosity oils in HDD applications, limited back serviceability may impact the uptake of the new lower viscosity API FA-4 oils.

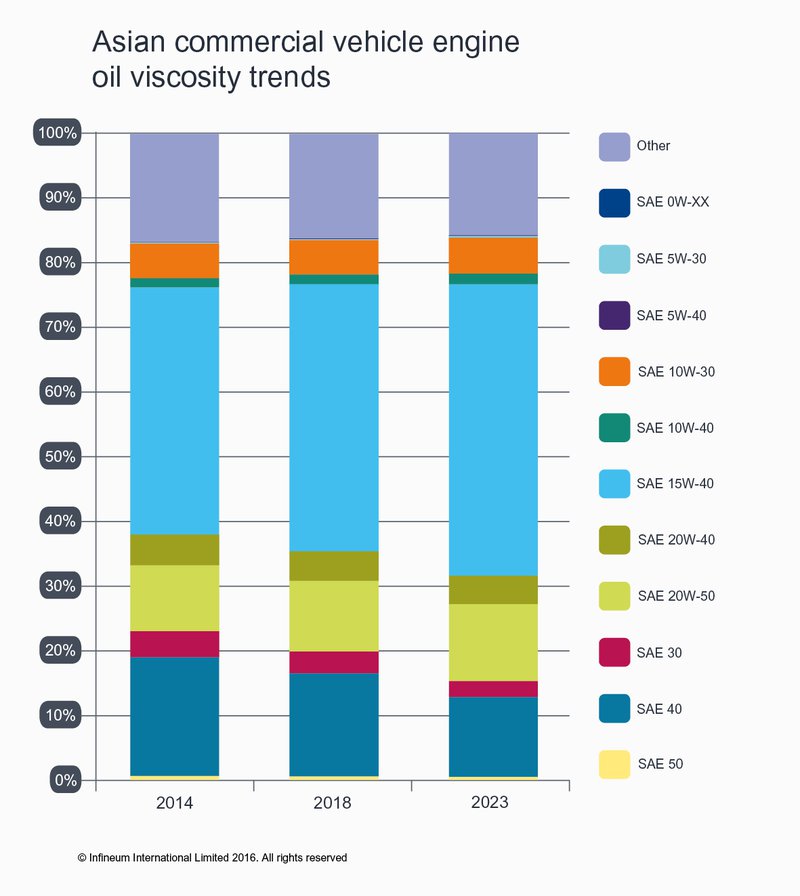

Asia HDD market slow uptake of lower viscosity

In Asia, we see a similar highly fragmented picture in the commercial vehicle market as reported for consumer vehicles. Here, as in North America, SAE 15W-40 is the mainstay grade in these applications. However, the uptake of lower viscosity grades is much slower. In the coming years, whilst the use of monogrades will decrease slightly we do not expect there to be any significant growth in the use of SAE 10W-30 or lighter grades.

Impact on base stocks

As the value of improving fuel economy to reduce CO2 emissions and running costs becomes increasingly important, a continued move to lower viscosity lubricants seems inevitable. To produce these products, the need for high quality.

base stocks with lower viscosity, higher viscosity index (VI) and lower volatility will increase. This means the pace at which the markets move to lower viscosity lubricants will be influenced by the availability and cost of high quality base stocks.

Right now the Group III market is long. Capacity from the Repsol-SK Cartagena refinery is already on stream and new capacity from Takreer’s refinery in Abu Dhabi is expected this year. This, combined with future volumes from Russia and North America, means there should be plenty available to meet the anticipated demand for premium products.

Current Group III should be fit for purpose to formulate SAE 0W-16 and 0W-20 viscosity grades with volatility performance in line with general industry specifications. In addition, unmet demand capacity for Group III offers base oil suppliers an opportunity to consider manufacturing Group III+, where economically viable, in order to differentiate themselves even further.

However, the introduction of ultra low viscosity oils or lubricants with tighter volatility requirements will require very high VI or low viscosity PAO base stocks to maintain performance. Currently it is not clear if there will be enough of these products to meet demand, which could increase investment challenges for all stakeholders.

We can expect regional quality demands to drive an increase in the global movement of high quality base stocks.

But, this is a very complex area, and the rate of growth of high quality base stock demand is inexorably linked to the change in the vehicle population. While new cars, with high specification lubricants, will replace older cars using lower specification lubricants, this will be a slow process. This is particularly true as the average car life in North America today is 12 to 15 years - even longer in some of the emerging countries - which means we do not expect to see a rapid change. All this uncertainty means the growth of these low viscosity grades and their impact on base stock demand over the next decade is very hard to predict.